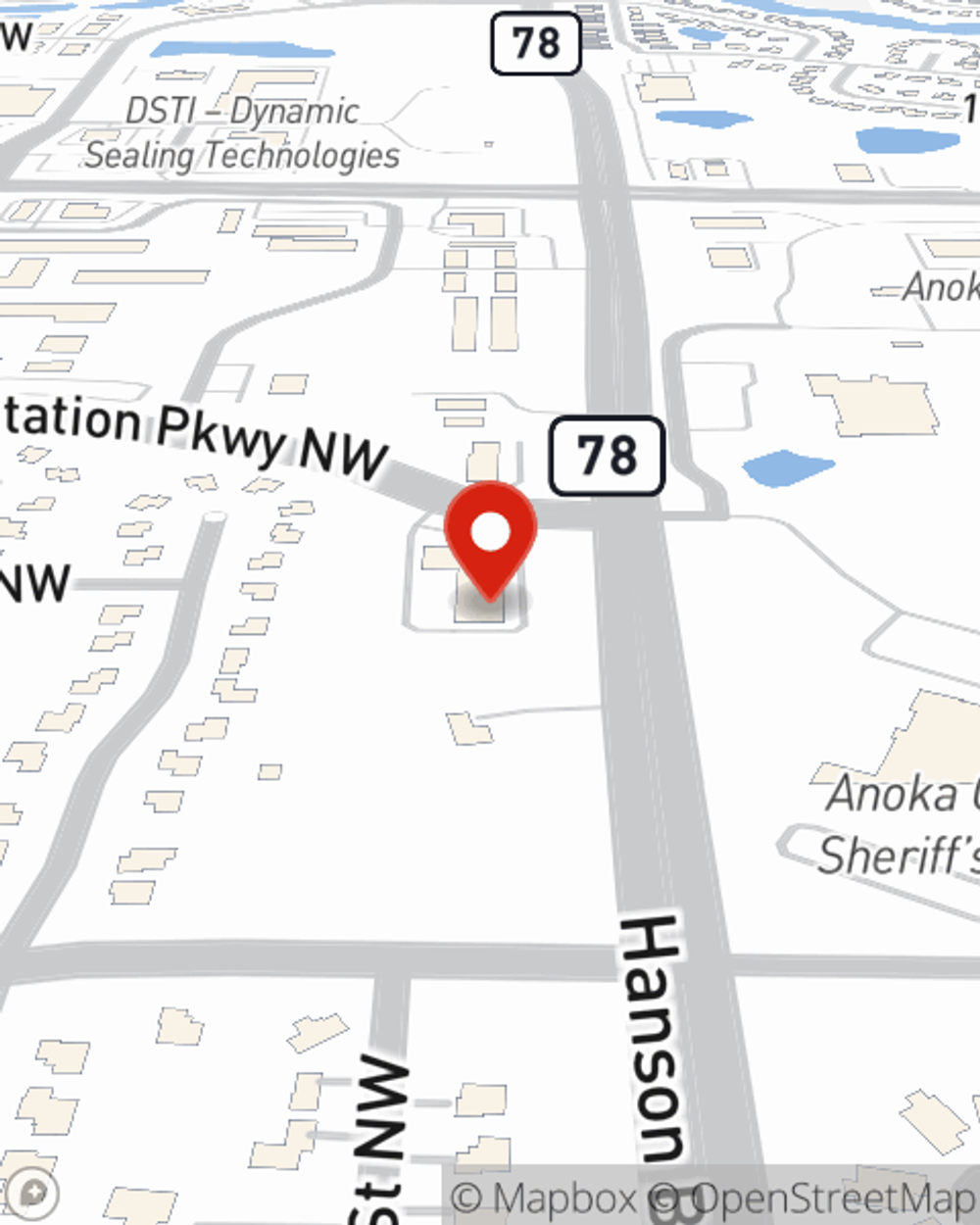

Business Insurance in and around Andover

One of the top small business insurance companies in Andover, and beyond.

This small business insurance is not risky

This Coverage Is Worth It.

Do you feel like there's so many moving pieces and it's hard to keep it all straight when it comes to owning your small business? It can be a lot to manage! Let State Farm agent Mike Mattingley help you learn about terrific business insurance.

One of the top small business insurance companies in Andover, and beyond.

This small business insurance is not risky

Cover Your Business Assets

State Farm has provided insurance to small business owners for almost 100 years. Business owners like you have turned to State Farm for coverage from countless industries. It doesn't matter if you are a lawn care service or a HVAC company or you own a bicycle shop or a pizza parlor. Whatever your business, State Farm might help cover it with personalized policies that meet each owner's specific needs. It all starts with State Farm agent Mike Mattingley. Mike Mattingley is the agent who understands where you are firsthand because all State Farm agents are business owners themselves. Contact a State Farm agent to familiarize yourself about your small business insurance options

It's time to reach out to State Farm agent Mike Mattingley. You'll quickly spot why State Farm is one of the leading providers of small business insurance.

Simple Insights®

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.

Checklist for apartment renting

Checklist for apartment renting

When finding an apartment, it’s important to know what to look for so you can make a smart assessment about each property you’re interested in.

Mike Mattingley

State Farm® Insurance AgentSimple Insights®

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.

Checklist for apartment renting

Checklist for apartment renting

When finding an apartment, it’s important to know what to look for so you can make a smart assessment about each property you’re interested in.